SavCoins - Best Fintech Saving's Mobile App

SaaS

The Fintech industry is growing rapidly, encouraging traditional businesses to accept cashless payments. That’s precisely what the micro-savings mobile app is about. It enhances cashless transactions experiences while keeping them safe and secure.

Business Problem

Cash-based transactions are a hassle for everyone. For the seller, it's an administrative nightmare. For the consumer, it's an expensive and time-consuming process with the potential for fraud.

Cash-based transactions are also expensive for businesses to process and manage because they require cash to be stored on-site and handled multiple times during each transaction. With cash-based transactions, businesses need to invest in unique safes or lock boxes to secure their cash receipts until they're deposited into their bank account. Banks also charge merchants fees for handling cash deposits and withdrawals.

Therefore, the need for a convenient system was more important than ever.

Solutions Overview

Our client needed a solution that makes it easier for their customers to pay from their phones. They wanted to eliminate the need to rely on cash.

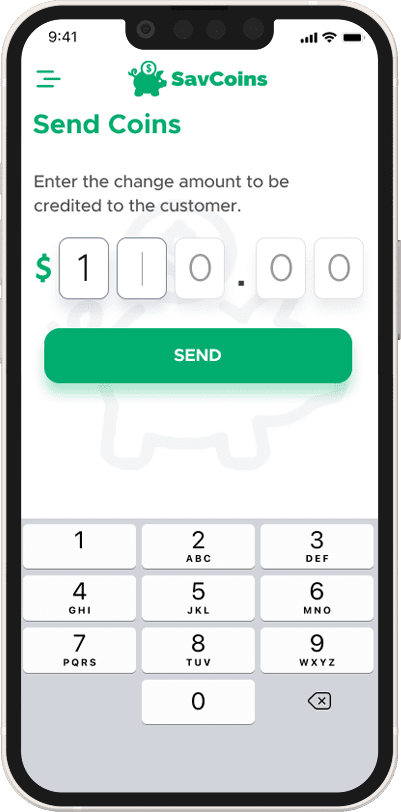

We came up with the idea of a micro-savings mobile app that allows merchants and customers to complete payments via their smartphones. The customer would receive a cashback for every transaction they complete with the wallet.

Quick Intro to the Micro Savings App

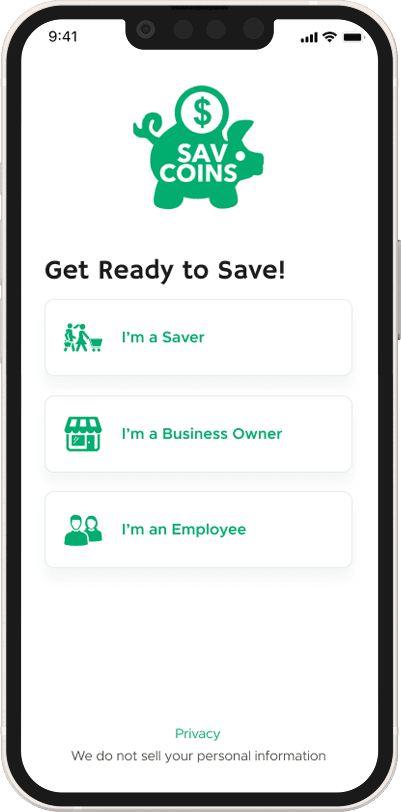

- Anyone can create an account on the app. They’ll be prompted to choose between “customer” and “merchant.” They’ll then be requested to enter their complete details. Customers can add money to their wallets using their cards (debit and credit) or net banking.

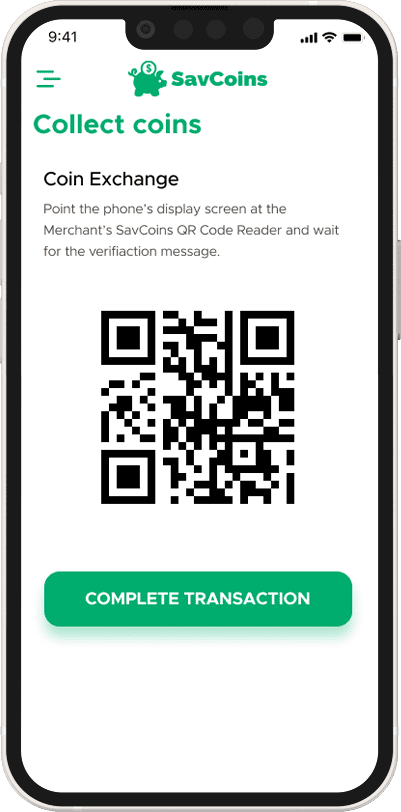

- Customers can then choose an outlet, scan the QR code, and make payments.

- Merchants can keep the money in their wallets or transfer it to their bank accounts.

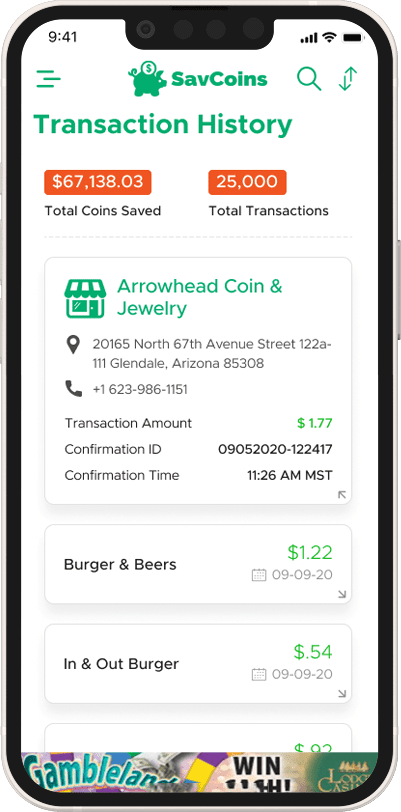

- Both customers and merchants can check their transaction history to stay abreast of the payments.

Our Development Process

- Our team began with market research to understand the existing solutions and how we can make a better solution. After multiple meetings, we finalized the roadmap of the application.

- We sent the document to the client for further discussion. After collaborating, we better understood the features we needed to add/remove based on their requirements.

- We then optimized the documentation so everyone stayed on the same page.

- Once the client approved the document, we started planning the app (the logic, technology, design prototypes, and database management).

- We then leveraged the test-driven approach to speed up the entire process without compromising quality.

Challenges

- The biggest challenge in this application was implementing the SaaS model. The client wanted the admin to be able to manage multiple merchants simultaneously. Thus, we took time to brainstorm and understand the revenue model to provide a better solution.

Solution

-

SaaS Platform

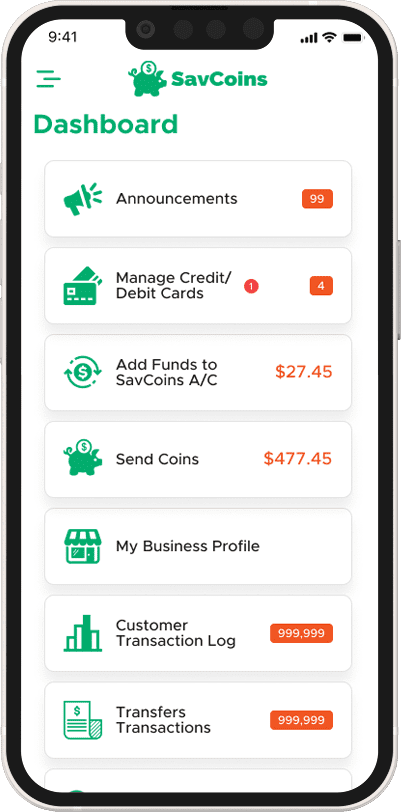

The mobile app follows the SaaS model, meaning the admin can manage multiple merchants simultaneously. They can monitor the transactions and ensure it is being used per the company guidelines.

-

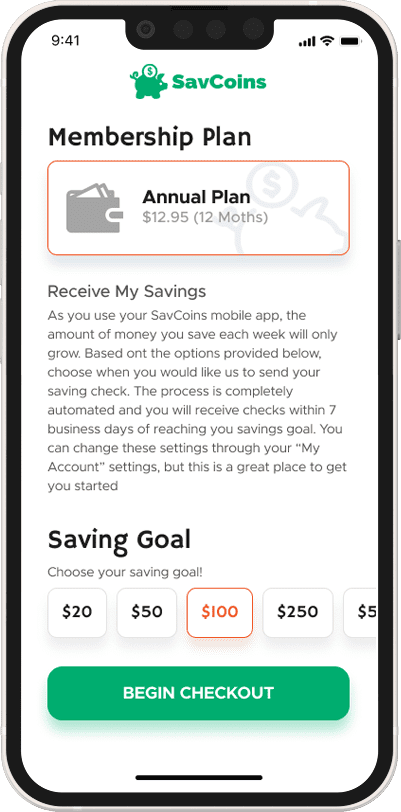

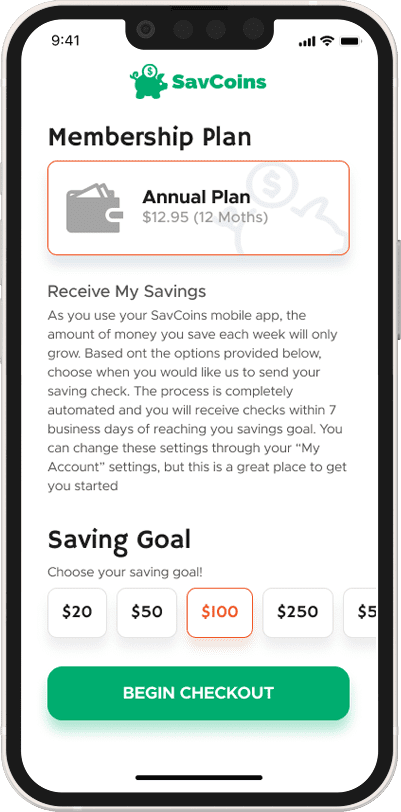

Membership Options

Users can choose from multiple membership options and pay via the in-app payment feature.

-

QR Code

Making payments via QR codes is seamless and allows users to pay quickly without asking for details. Plus, they’d get a cashback every time.

-

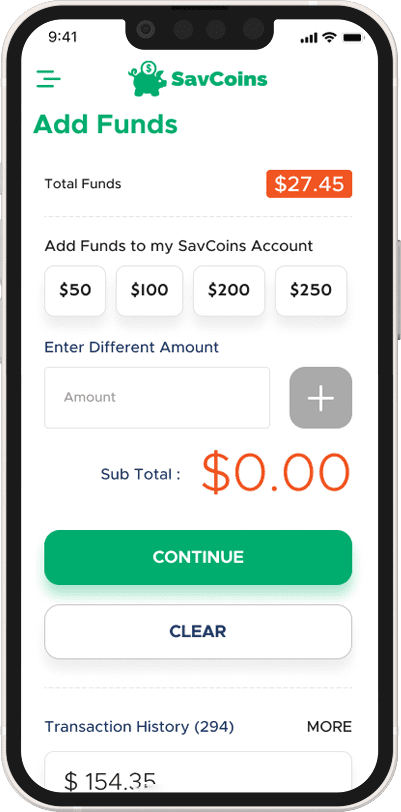

Digital Wallet

It allows users to add money for a faster checkout and better track their finances.

-

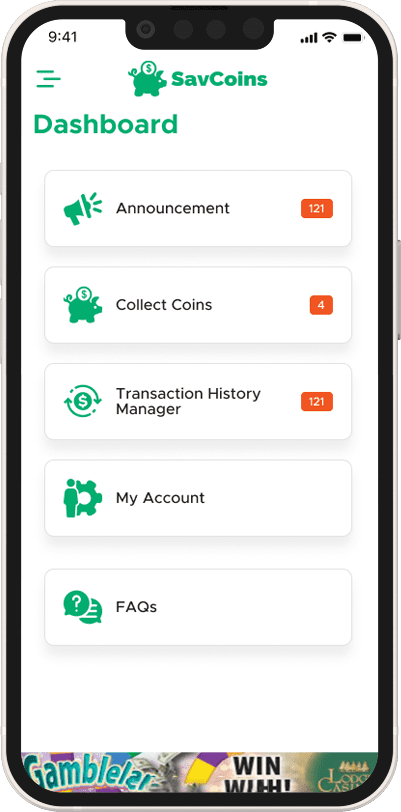

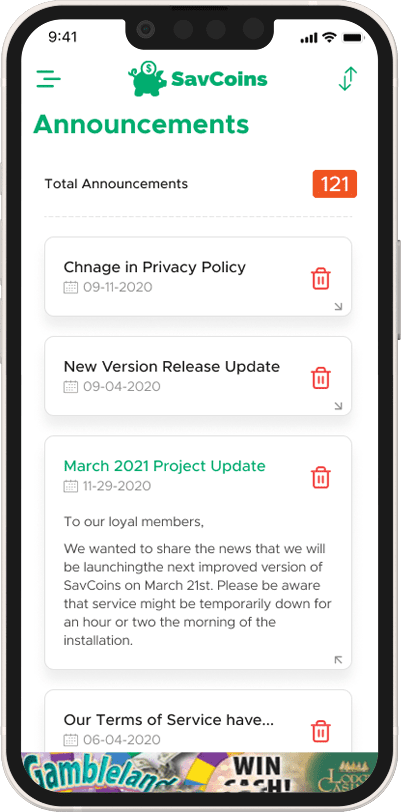

Announcements

It gives users access to important announcements like new features, payments, etc.

-

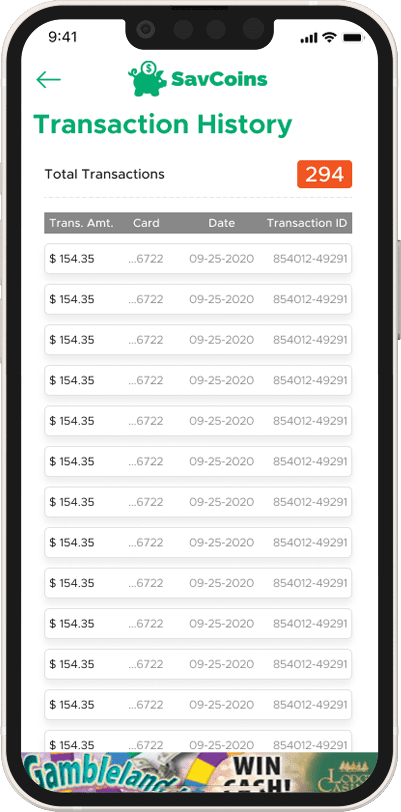

Transactions reports

Users can track their transactions in detail via the mobile app.

-

Staff Management

The merchants can manage their staff accounts and provide access to mobile apps.

-

Reports Management

Admins can manage customer and merchant reports and send them via email.

-

Push Notification Module

Increase engagement by sending push notifications and driving interest.

App Screenshot

Do you want to convert your ideas into a reality?

Let's talk about that!Similar Portfolio List

Throughout the years of service, we have offered path-breaking services.